Diversify and grow with ease: Mutual Funds, your path to prosperity.

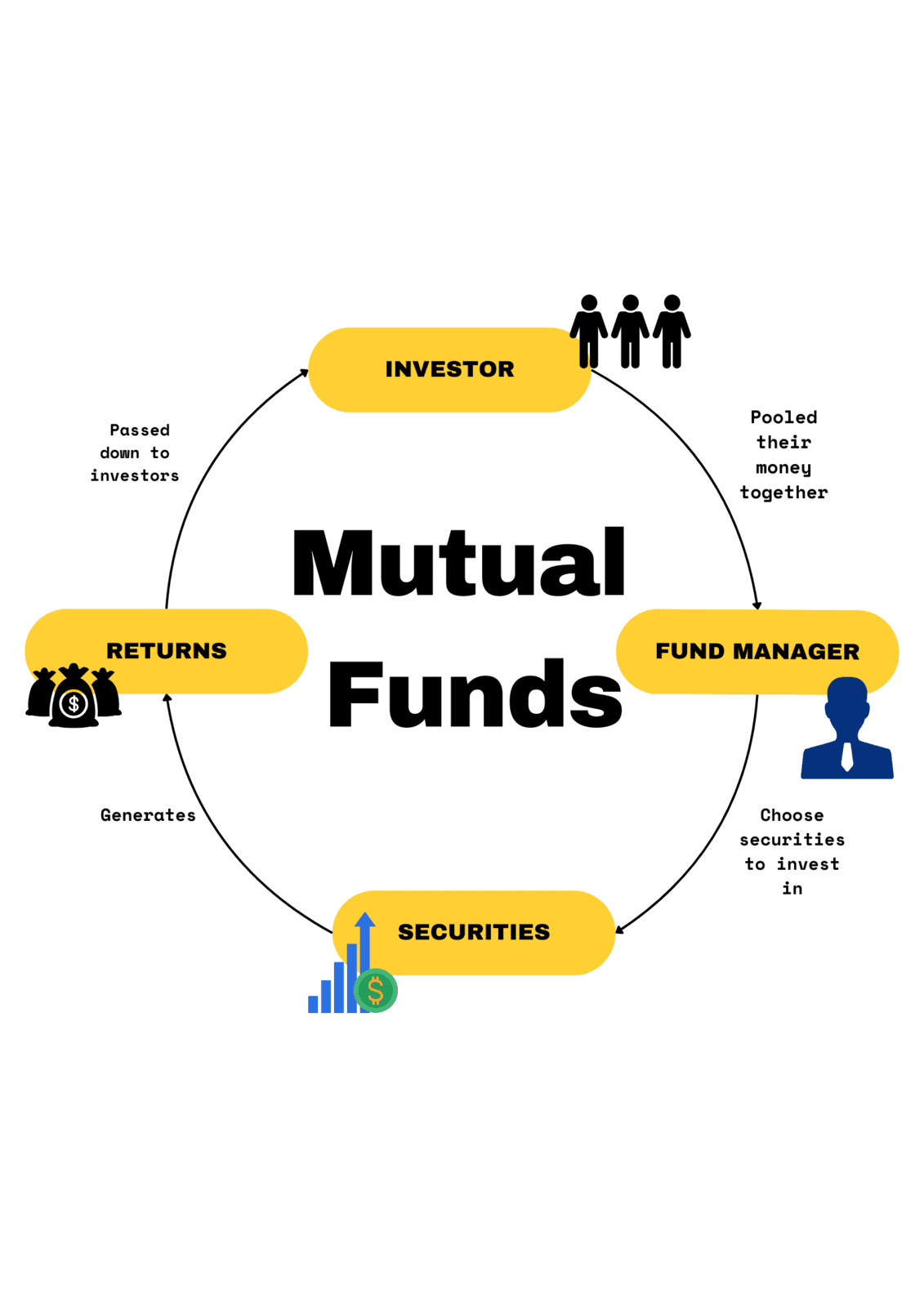

Understanding How Mutual Funds Work

Understanding How Mutual Funds Work

When you purchase a mutual fund, you are pooling money with other investors. The money pooled together by you and other investors are managed by a fund manager who invests in financial assets such as stocks, bonds, etc. The mutual fund is managed on a daily basis

Professional Management

Professional Management

Mutual funds are actively managed by a professional who constantly monitors the fund’s portfolio. In addition, the manager can devote more time selecting investments than a retail investor would.

Investment Diversification

Investment Diversification

Mutual funds allow for investment diversification. A mutual fund invests in several asset classes and not just a single stock or bond.

Liquidity

Liquidity

Mutual funds possess high liquidity. In general, you are able to sell your mutual funds within a short period of time if needed.

Mutual Fund Categories

Equity Funds

Experience the benefits of growth-oriented investments through our carefully curated equity mutual funds, tailored for your prosperity

Hybrid Funds

Experience the best of both worlds with Hybrid Mutual Funds—where the stability of fixed income meets the growth potential of equities, creating a balanced approach to wealth creation.

Debt Funds

Invest wisely, grow steadily: Explore the benefits of debt mutual funds for a balanced and secure financial portfolio.