The Story

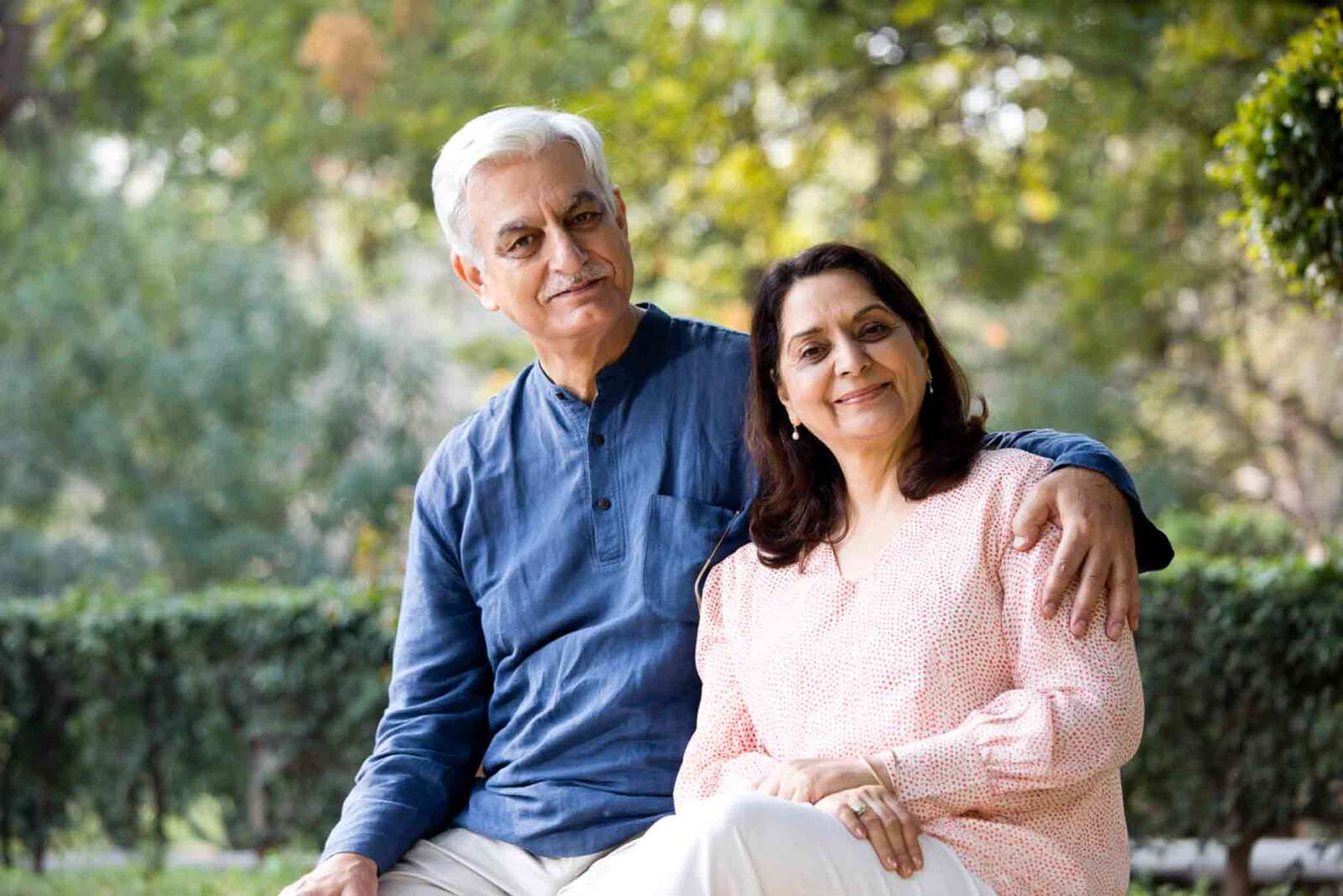

Mr. Ramesh Iyer, a 55-year-old senior manager in a reputed IT firm in Bengaluru, and his wife, Mrs. Latha Iyer, a 52-year-old school teacher, had always lived a modest, well-planned life. Their two children had completed their education and were settled in jobs abroad. While they had no immediate family responsibilities, retirement was approaching, and they realized the need to plan wisely to ensure a financially secure and peaceful post-retirement life.

The Challenge

Despite decent savings in PPF, fixed deposits, and a few insurance policies, the Iyers lacked a consolidated retirement plan. Their monthly expenses were about ₹60,000, including lifestyle and medical costs. They expected this to rise with inflation and possible health issues in later years. Mr. Iyer planned to retire at 60, giving them only five more years to prepare.

Financial Assessment

They approached a certified financial planner who conducted a thorough assessment. The planner calculated that to maintain their lifestyle for the next 25 years post-retirement (assuming a life expectancy of 85), they would need a retirement corpus of approximately ₹1.8 crore, factoring 6% annual inflation and 8% return on investments post-retirement.

The Solution

The financial advisor helped the Iyers realign their savings:

1. SIP Investments: Started monthly SIPs of ₹50,000 in diversified mutual funds to build the corpus faster.

2. Health Insurance: Upgraded their health insurance to ₹20 lakh each, with a top-up plan to protect savings.

3. EPF & PPF Review: Retained EPF as a stable income source post-retirement; moved some PPF maturity funds to hybrid mutual funds.

4. Estate Planning: Created a will and nominated their children to avoid future legal issues.

The Outcome

After five years, the Iyers successfully built a retirement corpus of ₹1.9 crore. With minimal debt, sound insurance, and a steady income plan from systematic withdrawal in mutual funds and pension schemes, they retired comfortably. Today, they enjoy travel, volunteer work, and financial peace of mind.

Conclusion

Mr. and Mrs. Iyer’s story reflects the importance of early and strategic retirement planning. Even at 55, focused financial advice and disciplined investing helped them retire stress-free. It's never too late to plan — but the earlier you start, the better.